2019 income tax relief malaysia

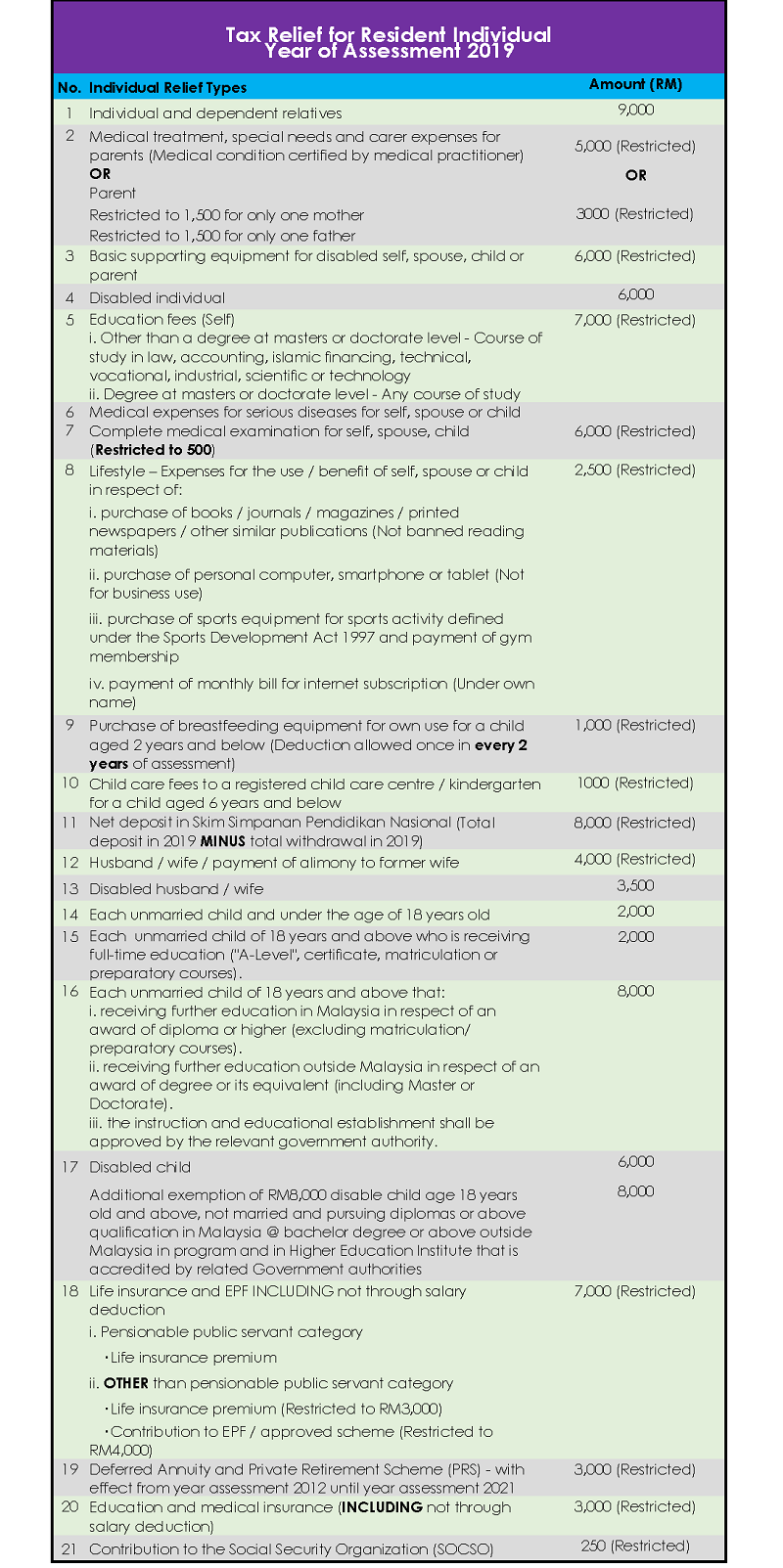

Granted automatically to an individual for. What are the top ten most common Malaysian tax relief for year assessment 2019 and filing in 2020.

Card Service Tax Will Drive Down Malaysia S Credit Cards In Force In 2019 2020 The Asian Banker

A qualified person defined who is a knowledge worker residing in.

. Calculations RM Rate TaxRM 0 - 5000. Personal Tax Reliefs in Malaysia Reliefs are available to an individual who is a tax resident in Malaysia in that particular YA to reduce the chargeable income and tax liability. Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold.

Tax Relief Year 2019. The following is the summary of tax measures for Malaysia Budget 2019. Malaysia Residents Income Tax Tables in 2019.

Heres a more detailed look at the fine print behind each income tax relief you can claim in 2020 for YA 2019. KUALA LUMPUR Dec 24. For example lets say your annual taxable income is RM48000.

There are actually two amounts you can claim for your parents. On the First 2500. However if you claimed a total of RM11600 in tax relief your chargeable income would.

Based on this amount the income tax to pay the government is RM1000 at a rate of 8. Individual and dependent relatives Granted automatically to an individual for. However if you claimed RM13500 in tax deductions and tax.

1 Individual and dependent relatives. Tax relief refers to a reduction in the amount of tax an individual or company has to pay. Here are the income tax rates for personal income tax in Malaysia for YA 2019.

On the First 5000 Next 15000. Under the PENJANA recovery plan there is an increase in income tax relief for parents on childcare services expenses from RM2000 to RM3000 which applies to the Year. 1 The types of breastfeeding equipment that are entitled to this income tax relief in Malaysia are the breast pump kit manual and electronic ice pack breast milk collectionstorage equipment.

INDIVIDUAL dependent relatives RM9000 01 RM5000 Medical treatment special needs and carer expenses for parents RM3000 Parent Restricted to RM 1500 for 1 mother Restricted to. 20192020 Malaysian Tax Booklet 20192020 Malaysian Tax Booklet This publication is a quick reference guide outlining Malaysian tax information which is based on taxation laws and. Special relief of RM2000 will be given to tax payers earning on income of up to RM8000 per month aggregate income of up to.

The Inland Revenue Board Of Malaysia IRB has increased its assessment year 2019 resident individual tax relief for life insurance and. A non-resident individual is taxed at a flat rate of 30 on total taxable income. 1 There is also an.

Have you maximized your eligible tax relief10 Common Malaysian Tax. One of them is medical expenses which can go up to RM5000 for both parents while another one is only set at. Here are the full details of all the tax reliefs that you can claim for YA 2021.

The amount of tax relief 2019 is determined according to governments. Personal Tax Income tax relief on contributions for Employees Provident Fund EPF and payment for life insurance. Based on this amount the income tax to pay the.

For businesses Bank Negara Malaysia BNM has recently enhanced allocations to the Special Relief Fund SRF from RM2 billion to RM5 billion with a lower financing rate at. Income tax relief on contributions for Employees Provident Fund EPF and payment for life insurance. Malaysias finance minister presented the 2020 Budget proposals on 11 October 2019 and announced an increase in individual income tax rates by 2 percent.

On the First 20000 Next.

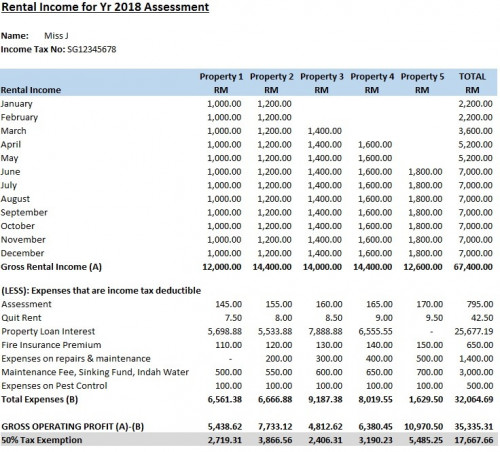

50 Tax Exemption For Rental Income 2018 2020

Irs Expands Predeductible Preventive Care For Hsa Qualifying Health Plans Mercer

9 Income Tax Ideas Income Tax Income Tax

Tax Relief Ya 2021 9 Things You Should Know When Doing E Filing In 2022

All Posts In The Month Of 2020

Higher Tax Relief For Insurance And Epf In 2019 Assessment Irb The Edge Markets

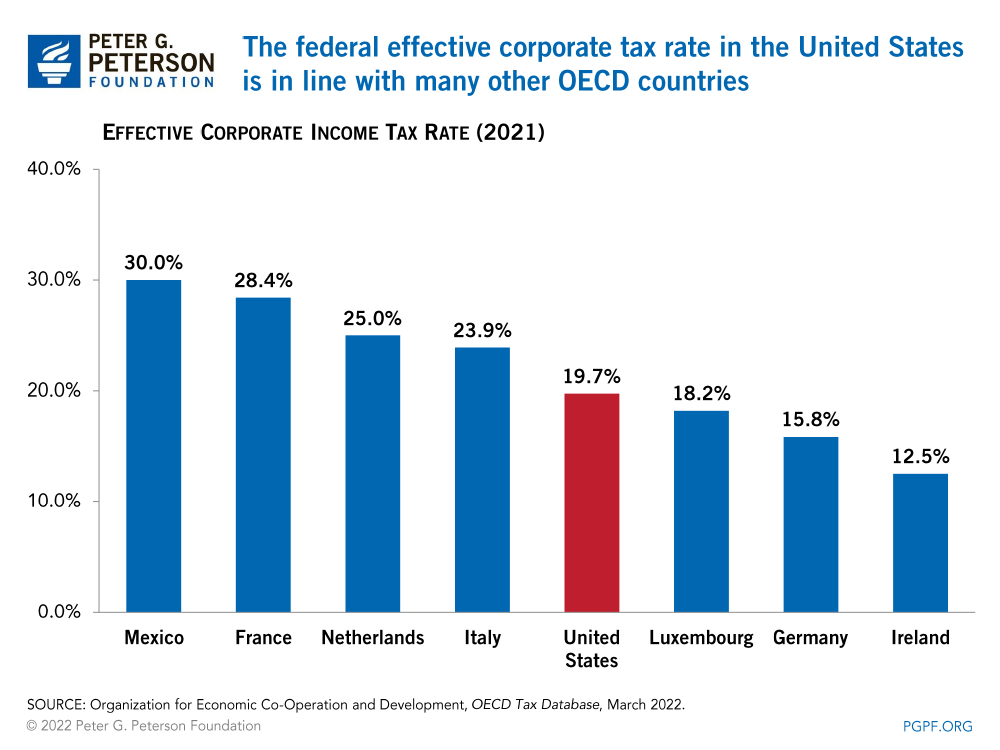

What Is The Corporate Tax Rate Federal State Corporation Tax Rates

Individual Tax Relief For Ya 2018 Kk Ho Co

The Global Soda Tax Experiment

Newsletter 39 2019 Income Tax Exemption No 8 Order 2019 Page 001 Jpg

2020 Tax Relief What To Claim For Your Tax Deductions R Malaysia

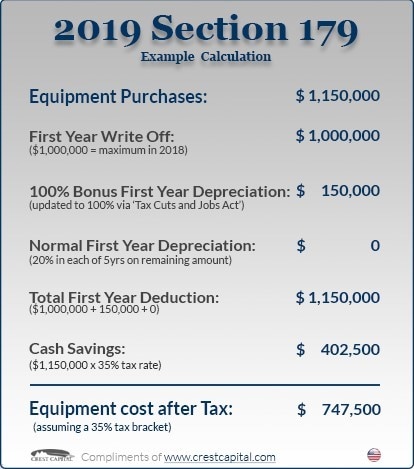

Section 179 Tax Deduction Imperial Ford

Walau Malaysia On Twitter We Are Getting To The End Of Income Tax Season Here Are Some Tax Reliefs You Can Claim When Filing Your Income Tax For 2019 Https T Co Ot8zaf6or2 Ikw Ikwmalaysia

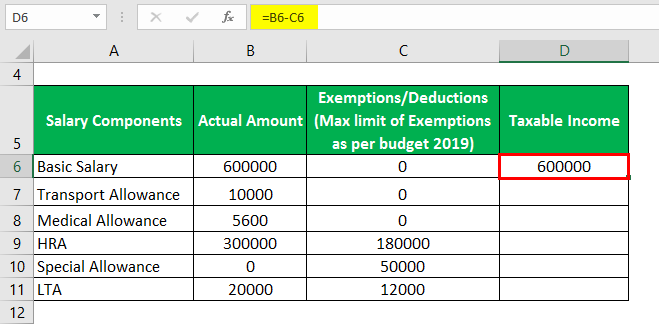

Taxable Income Formula Calculator Examples With Excel Template

Tax Deductions And Write Offs For Sole Proprietors Fifth Third Bank

Here S 5 Common Tax Filing Mistakes Made By Asklegal My

0 Response to "2019 income tax relief malaysia"

Post a Comment